Pepsico's Financial Performance Could Be Best Be Described as

In 2006 the companys net sales advance rose 8 to over 4. A volatile due to changing prices of its Q.

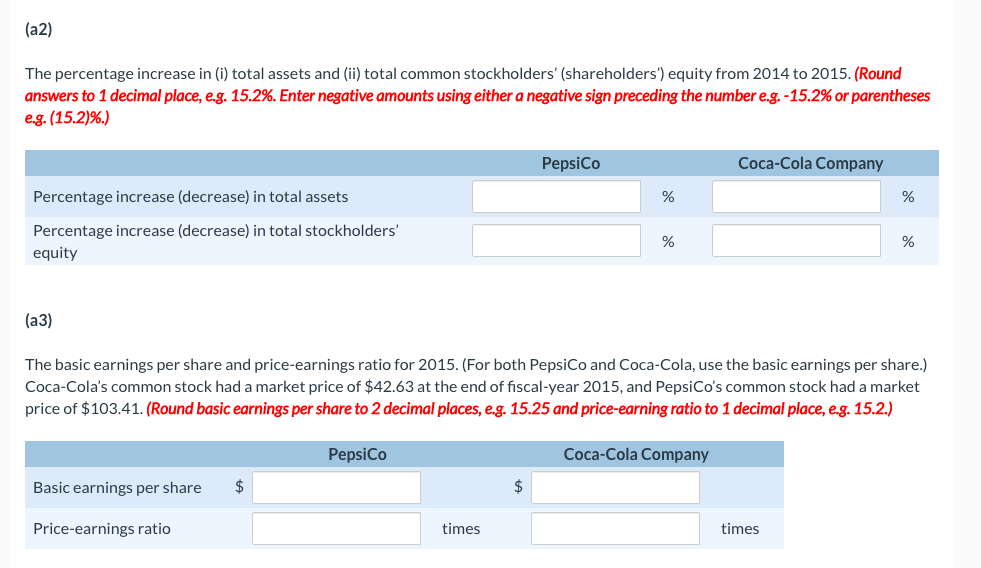

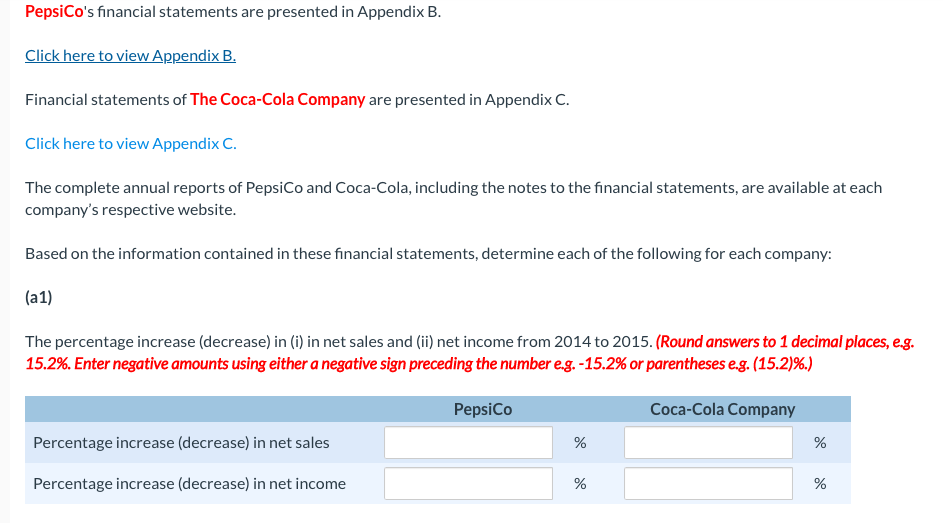

Solved Pepsico S Financial Statements Are Presented In Chegg Com

Annual Net Income - Infogram.

. This shows that PepsiCo has a very strong revenue growth. Ten years of annual and quarterly financial ratios and margins for analysis of PepsiCo PEP. Ten years of annual and quarterly financial ratios and margins for analysis of PepsiCo PEP.

KO may be able to produce more net income but PEP has been generating more top-line revenue than KO for decades. Please refresh and try again. Pepsicos financial performance could be best described as.

Internal control describes the policies plans and procedures implemented by management of an organization to protect its assets. Select the best answer below for the diversification strategy used by PepsiCo. Unfortunately something went wrong on the server processing your request.

PepsiCo has maintained a 14 net profit margin for the years 2009-2011 though this is lower as compared to its competitor Coca Cola. Organic revenue and core constant currency EPS are non-GAAP financial measures. A location of corporate headquarters B the similar.

Multiple Choice Unrelated diversification Related diversification A mix of related. THERE ARE MORE THAN 260000 PepsiCo employees worldwide. FINANCIAL MANAGEMENT OF PEPSICO.

What is PepsiCos corporate strategy. 1 volatile due to changing prices of its consumer units 2 decreasing due to economic trends in. A volatile due to changing prices of its Q.

Pepsicos financial performance could be best described as. Thank you for. This generic strategy focuses on cost minimization as a way to improve PepsiCos financial performance and overall competitiveness.

9 profit margins as compared to industry 8. PepsiCo provides guidance on a non-GAAP basis as the Company cannot predict certain elements which are included in reported GAAP results including the impact of foreign exchange and mark-to-market adjustments. Pepsicos financial performance could be best described as.

Balance sheet income statement cash flow earnings estimates ratio and margins. Pepsicos financial performance could be best described as. Then it might be relabeled as Performance with Purpose.

In terms of dividends the company has maintained a steady increase for the past several years with a current yield of over 28 PepsiCo vision and strategy 2007. View PEP financial statements in full. A all business units are equally strong busin.

Which of the follow are. A identify how well the diffe. Which of the following is a key strength for Pepsicos portfolio.

1 all business units are equally strong business fits 2 Frito Lay and Quaker Oats due to purchasing and production similarities 3 all units but Rice-A-Roni 4 all units but Tropicana Juices Question 2 83333 points Pepsicos financial performance could be best described as. PEPSICO PRODUCTS ARE ENJOYED BY CONSUMERS MORE THAN1 BILLION times. So Performance with Purpose could potentially benefit by being more effective as a device for optimizing and concentrating employee energy and resources in statements of stronger individual commitment focus and passion especially as regards PepsiCo customer value provision.

Pepsicos financial performance could be best described as. PepsiCo uses cost leadership as its primary generic competitive strategy. A volatile due to changing prices of its consumer units B decreasing due to economic trends in the periods presented in.

A strong performance was delivered by Pepsi with growth in revenues along with increase in net income ensured sustainable performance. In constant currency core earnings were up 9 from the year-ago. PEP has produced consistent net profit margins of around 10 while KO margins have been in the 15-18 range for the past several years.

Reported financial statements reflect its operating performance and to their usefulness for forecasting future cash flows. Through PepsiCos Sustainable Farming Program SFP strive to sustainably source our direct agricultural raw materials by 2020 0 242 51 2 100 2020 TARGET of directly sourced crops grown by farmers engaged through our SFP by 2020 34 79 99 100 2020 TARGET Seek to sustainably source our traceable non-direct. PepsiCos third-quarter core EPS of 166 beat the Zacks Consensus Estimate of 148 and also increased 64 year over year.

Please refresh and try again. Unfortunately something went wrong on the server while processing your request. For example to compete against Coca-Cola products PepsiCo offers low prices based on low operating costs.

For more detailed information on the Income Statement check out our new definition page here. PepsiCo provides guidance on a non-GAAP basis as we cannot predict certain elements which are included in reported GAAP results including the impact of foreign exchange and commodity mark-to-market net impacts. Where are the most strategic value fits for Pepsico.

PROJECT WORK FINANCIAL MANAGEMENT PRESENTED BY- RAJAT MORE BCOM LLB. A volatile due to changing prices of its Q. PepsiCo operates about 100000 distribution channels and approximately 10 million outlets are regularly served.

Lifeblood of any enterprise Planning and Control on financial activities Based on principle that need for money is continous Inflows and Outflows be properly mathced. The 1992 COSO Report is important because it established a common definition of internal control for assessing control systems as well as determined how to improve controls. Financial reporting quality relates to the accuracy with which PepsiCo Inc.

5 billion during the first quarter alone and earnings per share increased by 17 to. After reviewing the 9-cell matrix senior management at Pepsico could. Aggregate accruals deriving measures of the accrual component of PepsiCo Inc.

For detailed financial analysis please refer section 7 above. ABOUT PEPSICO PERFORMANCE WITH PURPOSE is PepsiCos vision to deliver top-tier financial performance by improving the products we sell operating responsibly to protect our planet and empowering people around the world. And Outlook for additional information regarding PepsiCos full-year 2021 financial outlook and long-term financial targets.

A volatile due to changing prices of its consumer units B. PepsiCo recorded a 33 debtequity ratio and 10. You have been successfully unsubscribed from the selected lists.

Pepsico Q2 2013 Performance Infographics Infographic Infographic Marketing Information Visualization

Pepsico S Net Revenue Worldwide 2021 Statista

Solved Pepsico S Financial Statements Are Presented In Chegg Com

0 Response to "Pepsico's Financial Performance Could Be Best Be Described as"

Post a Comment